The New GST Reforms 2025 has bring a List of Goods Under 40% GST in India and here is a Complete List. We now have a new GST system often called GST 2.0 that has changed the tax setup. It has only two main slabs 5% & 18% along with a special 40% slab. The 40% slab is only for sin goods & luxury items like cars bikes & cigarettes. These changes came into effect on September 22 2025.

Today, In this article we will look at Complete List of Goods Under 40% GST on Mediafeed.

What Does the 40% GST Slab Include ?

Sin Goods:

The products that harm health now attract the highest GST rate. These are cigarettes cigars cheroots cigarillos & other tobacco items. These are also pan masala gutka & chewing tobacco. These are also carbonated drinks sugary beverages & caffeinated soft drinks. The aim is to stop overuse of such items & also raise money for the government.

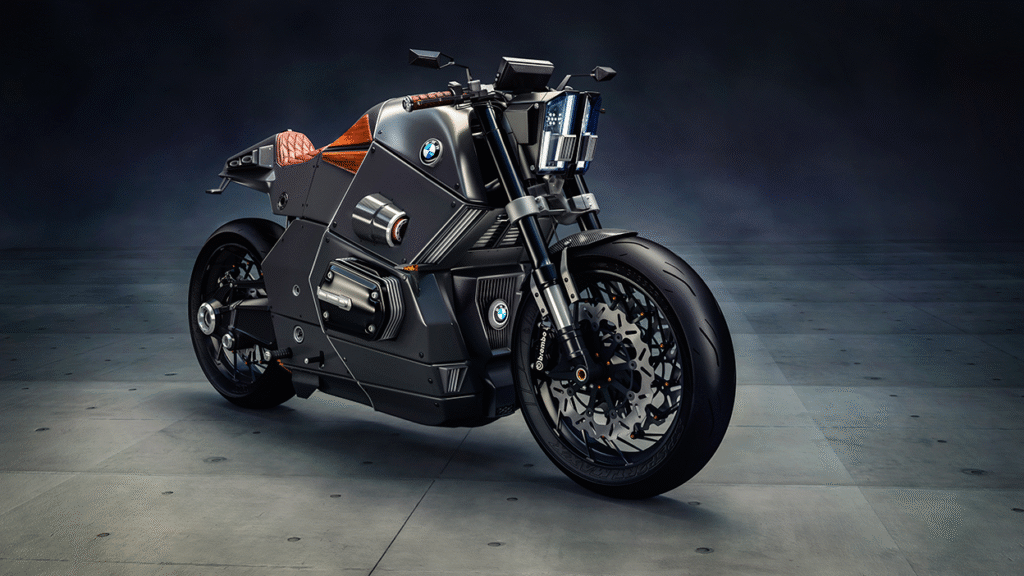

Super Luxury Automobiles & Bikes:

The luxury vehicles also come under this top tax level. These are mid size & large cars with engines above 1500 cc or length more than 4000 mm. These are SUVs MUVs MPVs & XUVs that now face 40% GST. These are motorcycles above 350 cc like Royal Enfield cruisers. These are yachts helicopters private jets & racing cars that also face 40% GST.

Also Read: US Bans Indians from Applying Visa

List of Goods Under 40% GST (Effective 22nd Sep 2025)

Here is the Complete List of Goods Under 40% GST that gives Relief to common People.

| Category | Examples & Criteria | GST Slab |

|---|---|---|

| Tobacco Products | Cigarettes cigars cheroots chewing tobacco | 40% |

| Pan Masala & Gutka | Pan masala gutka tobacco refuse | 40% |

| Sugary/Aerated Beverages | Carbonated drinks caffeinated sweet drinks | 40% |

| Luxury Cars & SUVs | Cars above 1500 cc or above 4 m SUVs & MUVs | 40% |

| High End Motorcycles | Bikes above 350 cc Royal Enfield cruisers | 40% |

| Leisure Transport | Yachts private aircraft racing cars | 40% |

Why GST 2.0 Matters for People ?

Simplification of GST Structure:

The old GST had 5% 12% 18% & 28% plus extra cess. The new GST has only 5% & 18% with 40% for sin & luxury. The change makes the system easy to use & understand.

Effective Tax Burden May Reduce on Luxury Cars:

The luxury vehicles had tax up to 50% in the past. The flat 40% GST now replaces both GST & cess. The new rule saves 8 to 10% for buyers. The model that had 48% tax will now face 40% tax. This change brings a clear drop in price for such cars.

Discouraging Unhealthy Consumption:

The high tax is a tool to reduce bad habits like smoking & overuse of sweet drinks. The 40% GST keeps these items costly to stop people from buying more.

Also Read: Complete List of Apps Banned in Nepal 2025

What Included in GST New Reforms 2025 ?

The GST system now has only two main slabs 5% & 18%. The 40% slab is only for sin & luxury items. The extra cess is removed & its cost added in the 40% GST. The small cars daily goods & simple items now enjoy lower rates.

Benefits to Consumers & Industries

- The buyers of small cars home goods & appliances pay lower tax now.

- The buyers of premium cars may see price cuts due to end of cess.

- The government & states get steady money with 40% slab while making tax easy.

- The public health goals stay strong with higher tax on harmful items.

Conclusion

At Last, We can Conclude that The new GST system in 2025 has two main slabs 5% & 18% with a 40% slab for sin & luxury items. The 40% GST covers tobacco drinks luxury cars bikes above 350 cc yachts & private aircraft. The List of Goods Under 40% GST is now clear & simple. The change also lowers price for some cars & keeps harmful goods costly.

Also Read: Complete List of Apps Banned 2025